(Almost) Every company performs worse than average

- Graham Boyd

- Oct 1, 2023

- 6 min read

Updated: Oct 4, 2023

Which means that every portfolio performs worse than average.

And this is true, regardless of how you construct your portfolio. Whether you use modern portfolio theory in its standard guise, whether you spread evenly across risk; or use a dumbbell approach, with a good number of companies chosen as stable drivers of capital preservation, nothing in the middle, and a number of companies at the other end as drivers of capital growth; all of those companies are most likely to perform below average.

There is a better alternative to portfolio investing, ergodic ecosystem investing.

You may never have heard of the word ergodic before, but after reading this blog, you will never forget it! (In case you’re wondering how to pronounce it, think of it as saying “er-”, as you might if you can't quite think of what to say, followed by “-god-”, followed by “-ick”.)

Let's first look at why every company performs below average, then cover what an ergodic ecosystem strategy is, and then right at the end I’ll define ergodic itself. First the practical benefits, then the theory.

Why every company performs below average.

Let's take an extreme example to make clear why every company performs below average, by choosing a company to perfectly preserve capital, a company that is flat on average. Of course, some years it grows, and in other years it shrinks. To make this example really easy to try out yourself, whether a given year is good or bad is 50-50. You toss a coin, heads mean it grows, tails it contracts. In the good years it grows by 50%, and in the bad years it shrinks by 50%.

So, on average, a company like this in your portfolio does a perfect job of capital preservation, and you might think that so long as you have enough of these companies in your portfolio at the dumbbell end, you will do the job of capital preservation well.

In this case, how many companies do you need to do a good enough job? More than you can afford, no matter how much money you have to invest.

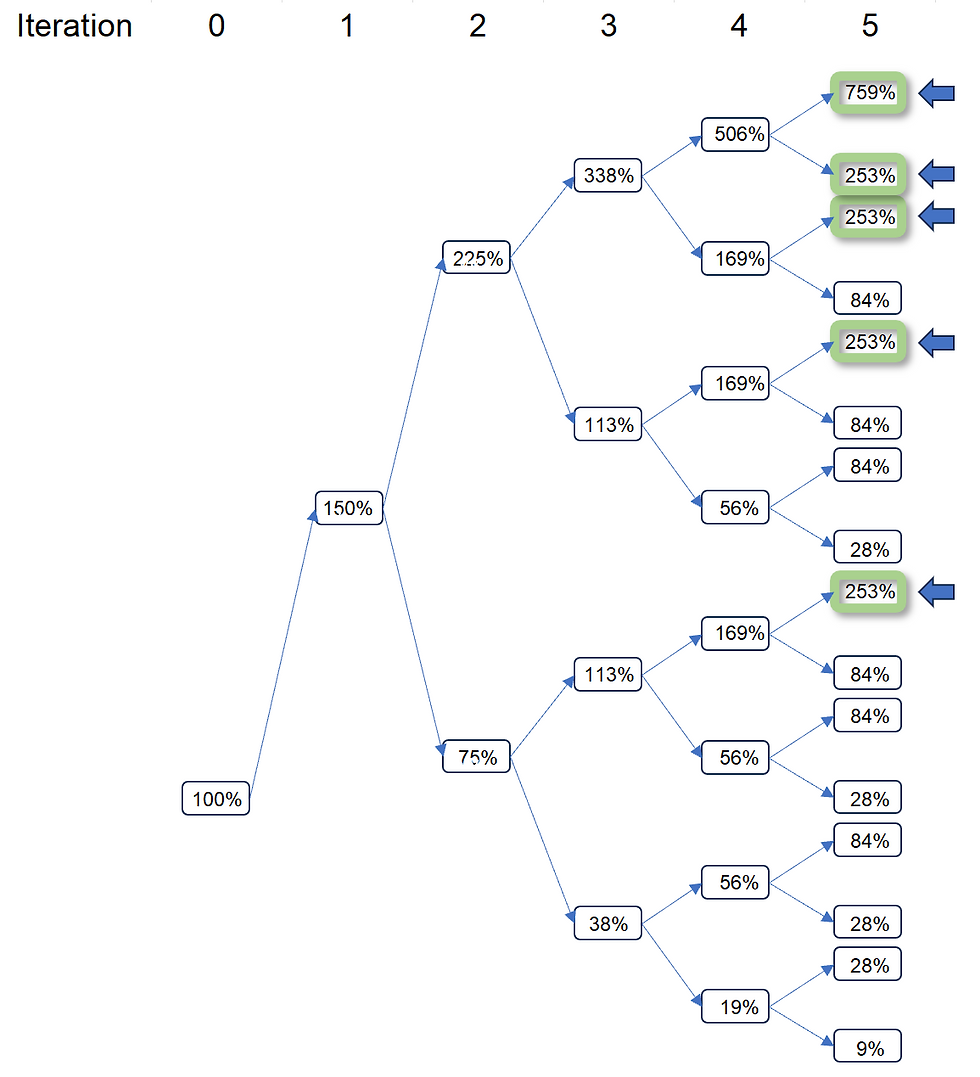

Have a look at this table.

What you can see is that in the first year - the company will either grow from 100% to 150% or shrink to 50%. The average is clearly still 100% after one year.

If you had in your portfolio one company that grew and one company that shrank, on average your portfolio does perfectly its job of capital preservation.

Now let's extend this out as you see in the table below to year five.

You can see that 26 of the 32 companies perform below average, some of them significantly below average. And the average is primarily driven by the six companies far above average: one company at 760%, and the five at 250%.

What you see now in year five, to keep the portfolio average at 100%, you need to invest in all 32 companies at the beginning. The average across all 32 companies is exactly the performance you expect on average, namely perfect capital preservation.

So this makes it clear; portfolios will fail to deliver the risk-adjusted returns you put into your design parameters unless you have enough money to invest at the beginning in a large enough number of companies to be certain that you had enough of the rare above-average companies.

You can already see that this means you have to have a big enough number to be certain that you will have at least 6 out of each 32 that you invest in. To have enough confidence, of having the one in 32 that dominates the average you will need to invest in at least 500 companies.

Do you have enough money to invest like this in 500 companies?

Here’s a diagram showing what happens in a more realistic case of a high-growth startup, one where the average delivers 1.34% growth each week, leading to a doubling in size each year. The solid line shows what such a company will do on average, double each year; the dashed line shows what a typical company will do, and the heavier dots show the average in a portfolio of 50 of these companies. First, let’s zoom in on the first year.

And now let’s look at the next 9 years as well:

But it’s even worse if you’re investing for your retirement. What you want to know is what your investment will do when you're retired; maybe beginning in 30 years' time, and ending in 70 years. The last thing that you want in your retirement is to run out of money in your final years.

There is a better way: ergodic investing.

Ergodic investing strategies are ones that get each of the companies as close as possible to the average. It achieves this through a blend of competition and collaboration between the companies.

This is not something that you can do as an individual investor, fund, or even as a syndicate. The stock market cannot do it. Only the businesses themselves can do it.

The companies need to commit to an optimum level of financial pooling.

The optimum is, like any optimum strategy, a moving target dependent on the entire business context. Each pool, each company, needs to find its optimum. An introduction to how to do so is covered in our ergodicity masterclass and in our book The Ergodic Investor and Entrepreneur.

Let's look at the simple example above again, but now with 100% capital pooling, to illustrate it, and then at the more realistic example.

Immediately after the first year, you have one company that has grown by 50% and now has a capital balance of 1.5, and one company that has shrunk by 50%, with a capital balance of 0.5. They merge all of their capital into a central pool and divide it out equally again, so each company starts year 2 with exactly 1 unit of capital again.

Repeating this each year, you can see that at the start of each year you are doing the job of capital preservation perfectly. Each company starts each year with a capital balance of 1, regardless of whether it got lucky the previous year and grew, or unlucky and shrank.

So you can see, in this simple example, three things.

Every individual company in our economy today is almost certain to perform below average.

Therefore, every portfolio is likely to perform below average, or worse than expected, regardless of which portfolio theory you use to fill your portfolio.

Only an ergodic strategy, one with some form of financial pooling between the companies, and an aligned strategy from the investors to only invest in the ecosystem of profit pooling companies as a whole, not individual companies, is capable of getting you as close as mathematically achievable to the promise that modern portfolio theory makes, but cannot deliver: risk-adjusted returns.

Taking the same graph you saw above, but now with the 50 identical companies following an ergodic strategy you get completely different performance. First, let’s look at a 10% fractional profit pool:

And now at 80% fractional profit pooling:

The percentage is the amount of profit (only the profit, not the capital) that each company puts into the central pool at the end of each week, and which is divided out again at the start of the next week.

Even the 10% delivers a 10X growth on average over ten years, beating 95% of typical 10-year VC funds, and far better than the original zero pooling portfolio. And the 80% pooling delivers a phenomenal return of 1000X!

Of course, once you factor in all the other dynamics in business, it’s clear that 80% is seldom viable. You need enough competition; just not 100%!

Now, let’s look at a few deeper subtleties.

By failing to use an ergodic investment strategy, we are hemorrhaging money, which then drives our extractive economy to make up the shortfall by consuming resources.

It means that impact investors and entrepreneurs perform worse than average, and require either more money, or staff to work at low salaries.

Also means that the larger your portfolio, the more likely you are to strike it lucky and have one of those rare instances where the company performs better than its average expectation.

One of the reasons why large countries with large stock markets perform better on average than small countries with small stock markets. They are simply more likely in any decade to have a rare company that is lucky enough to perform better than average.

Definition of ergodicity, and non-ergodicity

A business is ergodic if and only if the actual performance of that business over some long enough period of time is equal to the average value.

If it is not, the business is non-ergodic.

And the maths of non-ergodic capital growth means then that the actual performance you can expect from the business over a long enough period of time is always less than the average. This is just the way the maths works.

And that’s what I mean when I say that every business, and therefore every portfolio, performs worse than average.

To find out more …

To understand this in more detail, and what you as an investor or an entrepreneur can do differently to get the best possible performance out of your investments, read my book The Ergodic Investor and Entrepreneur.

Attend our ergodicity masterclass for you as an investor or entrepreneur to put this into practice; and if you want to know more about what we are doing in Evolutesix to build an ergodic ecosystem holding startup and venture studio, take a look at these slides. And if you are interested in investing, and eligible to invest in unregistered securities, contact us at Evolutesix.

Commentaires