Commentary:

This past week was volatile.... it was an up with the job numbers followed by a down week with CPI. Jobs, CPI, and Fed all occur in a 4-day span--- a rare occurrence.

The next jobs release is July 5. June 7 came in at 272,000 and unemployment rate rose to 4.00%. The prior month was 175,000 and 3.9%

The next CPI release is July 11. June 12 came in a 0.0% and annual CPI decreased 3.4% to 3.3% May's 0.0% is important, we could have a 2.8% CPI on Sept 11 when the August data is released.

The Next Fed meeting is July 31. June 12 no change, signaled that there may have one change later in 2024. It is worth noting: there are only 2 Fed meetings left before the Nov 5 election: July 31 and Sept 18.

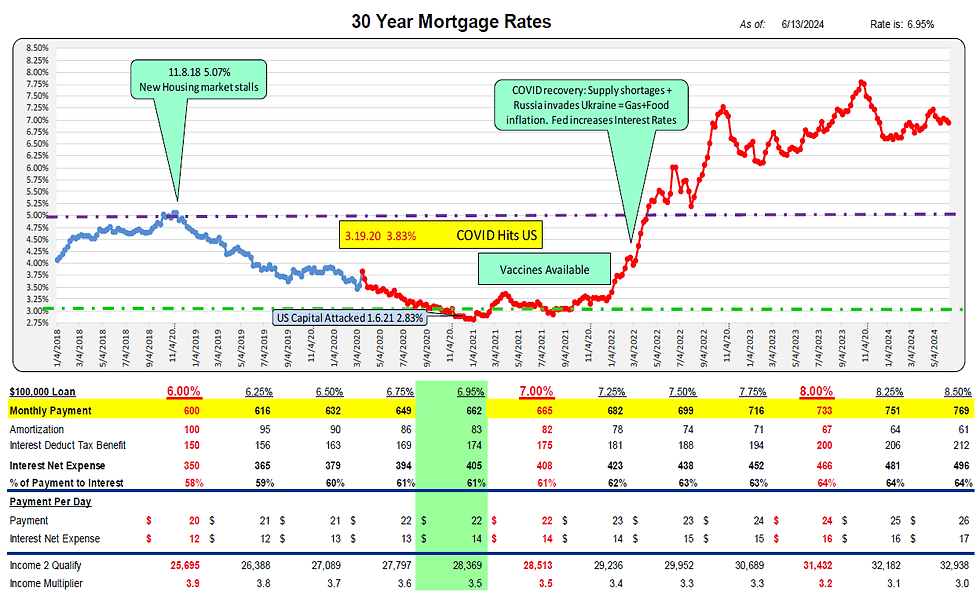

For the week ending 6.13.24 Mortgage rates DECREASED 4bp to 6.95%.

For a $100,000 loan the monthly payment DECREASED $3.00 and to $665/mo or $0.09/day.

Mortgage rates DECREASED 4bp while the 10-year Treasury rates also DECREASED 4bp for the week ended 6/6/24. Spread remained at 271bp. With the historical spread being 168 there now exists a “safety cushion” of 103bp above the historical spread.

The historic spread between the 10-year Treasury and mortgage rates is 168pb (see green line, right axis) and currently is 103bp above the historical norm.

Comments