Pandemic reflationary policy and our social justice opportunity, Part 1

- Jeff Hulett

- Apr 20, 2021

- 8 min read

Updated: May 31, 2023

The Goldilocks Zone - an economic balancing act

The U.S. economy is going through significant economic turbulence. The turbulence has been created by the pandemic and has caused a massive deflationary impact. As a countermeasure, the U.S. Government responded with reflating oriented fiscal and monetary policy stimulus. This appears to be an effective response to restore economic efficiency but may have unintended social justice implications. An effective social justice program includes revamping our education system to recognize the great need for continuous skills updating and enhancement. This helps people climb the self-sustaining, wealth-building ladder.

This article is presented with the following sections:

Refilling the bucket

Recently, much has been written about our current economic environment. The conventional wisdom had been that inflation is not a fear, given the deflationary impact of the pandemic. (1) Now, bond yields are moving up. In fact, the benchmark 10 year U.S. Treasury yield, as of the writing of this article, is back to pre-pandemic levels. Think of the bond market as a group of rational voters. Currently, their voting record suggests a) the economy is on the mend and b) the current set of fiscal and monetary stimulus is expected to be inflationary. (I italicized expected since inflationary expectations are different than actual inflation. Just like the risk of being hungry is a lot different than actually being hungry)

I generally agree with conventional wisdom. I also believe there is much more to it. This article is about some of the nuances of our current economic environment and a suggested beneficial policy focus.

Sure, government spending is inflationary, but a pandemic is massively deflationary. There is a difference between inflation that acts to reflate our economy and high inflation. As observed in a recent The Economist article,

“Mild inflation is not to be feared. Indeed it is in part changes in the market's expectations of inflation that drive bond yields down in recessions and up in recoveries. But hopes for a reflation of the economy can quickly spill over into fear of higher inflation.” (2)

So, the questions become: Is the latest round of fiscal spending net inflationary, or is the bump in the bond market yields more fear than substance? Also, even if the latest fiscal spending is net inflationary, will it lead to high inflation or just back to normal monetary levels?

Frankly, it is easy to get inflationary pressure (a flow) confused with an inflationary environment (a stock). Stock and flow are different and will be clarified in the following section. Regarding government spending (a flow), there is a balance and it can be summarized with the following metaphor:

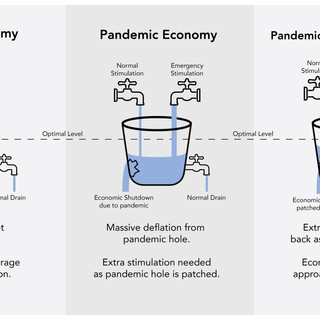

Our macro-economy is like a monetary fuel bucket that best operates when filled to a certain level (a stock). Think of the economy like a goldilocks scenario. The monetary fuel level can be too high, too low, or, ideally, just right.

Too High: If the monetary fuel bucket is too high, it will cause high inflation and the debasement of our currency. One of the starkest historical examples of high inflation impact was the Post World War I, Weimar Republic Germany. An inflationary environment that enabled Nazi Germany and World War II. (3)

Too Low: On the other hand, if the monetary fuel bucket is too low, this can lead to deflation. An example of deflation impact is the economically debilitating Japanese deflationary cycle, starting in 1991 and in some forms, has persisted to today. (4)

Just Right: So keeping the monetary fuel bucket at the right level is very important. [1] It is also very hard, especially given the complexity of our economy and the hard to coordinate dynamics between monetary and fiscal policy. It is easy to undershoot or overshoot the optimal monetary fuel bucket level. Unexpected policy inertia is sometimes hard to dampen.

Back to the metaphor, the pandemic is like a deflationary hole [2] in the side of the monetary fuel bucket, causing a leak (a flow) and the bucket level (a stock) to drop. Government spending is like an extra inflationary fiscal spigot (a flow) that runs to re-fill the fuel bucket back to the optimal level while the hole is patched.

The trick is turning down, then off, the extra inflationary spigot as the deflationary hole is fixed and the optimal monetary fuel bucket level is resumed. [3] As with most fiscal policies created during crisis and uncertainty, there is more political will and resulting bias for overshooting than for undershooting constituent assistance policies. Given this natural policy bias, look for future inflation and other unintended consequences from the current round of assistance. [4] An inflationary outcome is where fiscal policy inertia overshoots the optimal level as shown by the dotted line. In short, the bucket will overflow! When fiscal policy overshoots, inflation will occur. When inflation occurs, monetary policy will slam into reverse from today. Tightening monetary policy includes higher short-term interest rates and a reduction in quantitative easing. Expect all interest rates to rise in an inflationary environment. Of course, the future is unknowable. This prediction is taken from an understanding of macroeconomics and the typical interaction between fiscal and monetary policy. Time will tell!

While we think of the Federal Reserve ("the Fed") and monetary policy (5) when we think of “monetary fuel,” in this case, much fuel is coming from fiscal spending. Especially resulting from the 2020 CARES Act, the 2021 American Rescue Plan Act, and related fiscal stimulus provided by the federal government. The Fed had no control and little influence over fiscal policy. As such, the Fed is constantly reacting to fiscal changes to meet its objectives. (6)

The question of Social Justice

A key question about our economic recovery relates to the impact on social justice.

First, let us put social justice in the context of the 3 pillars of economic success. Namely:

Economic Efficiency

Individual Freedom

Social Justice

This context was put forth by John Maynard Keynes (7). Think of these as pillars to support our overall economy. It is important for each pillar to be at a mutually supporting strength and to provide economic balance. Let’s set aside individual freedom for now. The question as we work through the economic challenges of the pandemic is: “How do we balance economic policies as related to both Economic Efficiency and Social Justice?”

In our metaphor, the government is providing monetary fuel-related pandemic aid by leveraging our banking system. It is leveraged in a way usually reserved for driving economic efficiency. As such, an unintended consequence may be a negative impact on social justice. That is, not all boats will rise to the same level via the somewhat economically blunt and socially insensitive instruments used to 1) keep our fuel bucket filled and 2) to a reasonable economic efficiency enabling level. Meaning, those with little existing wealth (8) and exposure to pandemic-sensitive jobs, may use the fiscal stimulus as income replacement and lose ground relative to their wealth.

For the income replacement group, the best-case scenario is wealth stays at the current level, but may turn negative. Those with existing wealth and exposure to pandemic resilient or even pandemic benefiting jobs may use the fiscal stimulus to build more wealth. The outcome, potentially, impacts social justice by increasing economic inequality. By the way, I’m not saying these two outcomes are either mutually exclusive or even always bad. Those building wealth by investing may very well help those that use pandemic aid as income replacement. This occurs when the wealth-building group invests in companies that create jobs for the income replacement group.

My broader point being, helpful aid distribution fiscal policies will increase the likelihood that the income replacement group will receive investment to help transition to the self-sustaining, wealth-building ladder. This could occur by increasing training and other re-skill initiatives to move more people into the “information age” kind of job categories associated with pandemic resilient/benefitting jobs. In our article America's Mega Forces - Making the most in a time of change, we describe just such a program. Next is a summary snippet with more detail found in the Mega Forces article:

“Mega Force 2 idea: Information Age Education….. Create an adaptive continuing education system that provides most citizens ongoing, relevant education. This will be accomplished via employer and training institution incentives.”

The essence of the Information Age Education program is that our economy will likely remain in a state of change and require ongoing skill adaptation. Changes are driven by changing and disruptive technology. The Information Age Education program proposes to change how we thinking of education. We often think of education as something we only do when we are young. The program formalizes education as an ongoing lifetime endeavor. The program enables education as an ongoing personal investment, much the way we view exercise or other healthy habits. Also, the program is geared to help people transition from the income replacement group to the wealth-building group. While the Information Age Education program does not explicitly target specific social groups, it will tend to help social groups with higher exposure to lower levels of education and wealth.

Conclusion

The U.S. economy is going through significant turbulence. The turbulence was created by the pandemic and has caused a massive deflationary impact. The U.S. Government responded with reflating fiscal and monetary policy countermeasures. The response appears to be effective to restore economic efficiency but may have unintended consequences for social justice. An effective social justice program includes training and other measures to help people get on and climb up the self-sustaining, wealth-building ladder. The program provides incentives, infrastructure, and an adaptive curriculum to help all reinvent their skills as aligned with our technology-empowered world. The intent is to create an environment to broadly increase our ability to participate in long-term wealth building.

Notes

(1) Here is an example article, about “leaving inflationary fears behind.” - https://www.nytimes.com/2021/02/15/business/economy/biden-fed-inflation-covid.html

(2) The inflation bogeyman - Get ready for more bond-market scares. Beyond bond market yields, other ways of understanding inflation expectations are via 1) surveys of households and businesses and 2) inflation risk premium that helps measure tail risk. As of this writing, survey data shows alignment with current Fed data. However, implied risk premiums are increasing. For example, the implied probability that the CPI will be over 3% over the next 5 years is increasing. See The Economist article for a nice analysis of inflation expectations: Just how anchored are America’s inflation expectations?

(5) The Federal Reserve Open Market Committee (FOMC): The term "monetary policy" refers to the actions undertaken by a central bank, such as the Federal Reserve, to influence the availability and cost of money and credit to help promote national economic goals. The Federal Reserve Act of 1913 gave the Federal Reserve responsibility for setting monetary policy.

(6) The Federal Reserve's mandate: The Federal Reserve works to promote a strong U.S. economy. Specifically, Congress has assigned the Fed to conduct the nation’s monetary policy to support the goals of maximum employment, stable prices, and moderate long-term interest rates. When prices are stable, long-term interest rates remain at moderate levels, so the goals of price stability and moderate long-term interest rates go together. As a result, the goals of maximum employment and stable prices are often referred to as the Fed’s “dual mandate.”

(7) J.M. Keynes's Theory of the State as a Path to His Social Economics of Reform in "The General Theory" by Hans Jensen. Also, Zachary Carter does a nice job describing the 3 pillars context in his Keynes biography, The Price Of Peace.

(8) "Wealth," in this article, is set out with a traditional accounting definition. That is, the value of household assets - household liabilities = household wealth (aka, household equity). In a social justice context, inequality is often derived from a difference in household wealth across social groups. In general, the "income replacement" group discussed in this paper has little or no wealth, whereas those in the "wealth-building" group either already have wealth or maybe well-positioned to build wealth. In terms of building wealth, please see my brief article intended to help people design their own wealth-building strategies, Investment thoughts for my children. In short, there are 3 main considerations to building wealth:

#1 - Being content with yourselves and NOT spending money you don't have, NOT buying things you don't need, and NOT impressing people.

#2 - Having a long-term focus (and long-term is NOT two or three years). Wealth and security are built over decades, not months.

#3 - Very simply - Save, Invest, Evaluate, Rebalance, Repeat.

Admittedly, this is easier said than done, but certainly achievable with resources and support, including the Information Age Education program mentioned in this article.

Also, another resource for the advantages of long-term wealth building, please see our article The Time Value of Money Values the Young. The article shows how building wealth earlier in life is helpful. It also shows how our own brain works against us when trying to establish wealth-building habits.

Comments