Unrealized losses are only a subset of the bank's broader embedded loss inventory -- and that embedded loss inventory is about to be released. Understanding the embedded loss inventory is a necessary step to revealing loss challenges and preventing more failures.

These unrealized loss estimates are based on Q4 2022. Unrealized losses are a big problem for some banks in a rising interest rate environment. The problem occurs for banks that made outsized, insufficiently hedged interest rate bets on the long end of the yield curve. Silicon Valley Bank, Signature Bank, and First Republic Bank have failed. "Who’s next" is on everyone’s mind.

These unrealized loss estimates occurred just before the SVB failure. The reporting timing is critical. This was the last quarter before banks transitioned from a “compete and delay releasing bad news” mindset to a “survival and we might as well flush the losses” mindset. The banking industry's transition to the new "flush the losses" mindset is part and parcel of dynamic business cycle market psychology. The "flush the losses" mindset is noted in the next graphic's red space -- near the business cycle nadir. As such, it would not surprise if these or broader loss measures change or become more salient as the business cycle transitions.

In the companion article, Is Silicon Valley Bank the first of many?, specific bank failure causes such as liquidity management are explored. We also suggest healthy banks need to prepare for the penetrating questions they will be receiving from their regulators and all those with banking risk interests.

For this article, we step back. Unrealized losses are considered in the context of broader and harder-to-see embedded losses a bank tends to build or release at different times of the business cycle. Embedded losses are a broad category. It follows the structure of the bank's compliance and risk portfolio -- with the exception that some embedded losses occur from unknown risks. [i] As it stands now, we just transitioned to the release-embedded-losses part of the business cycle. The first step in releasing is understanding what those embedded losses are.

All banks have some timing discretion when revealing losses. This discretion comes from a few sources:

How accounting policy is interpreted and falls within bounds for FASB and GAAP [ii];

How hard the banks and their auditors are looking for loss problems; and,

Where the banks are looking for embedded losses. Since the great financial crisis, a more prescriptive regulatory approach has been implemented. This means that unprescribed risks are more likely to be missed. [iii]

The combination of these factors and likely other factors creates what is known as “embedded losses.” Unrealized losses are only one flavor of a bank's total embedded loss inventory.

Embedded Loss Transition

a business cycle and market psychology view

This embedded loss timing discretion is where accounting rule interpretation and risk management efforts meet human nature and self-interest.

IN GOOD TIMES: The dominant market decision psychology = GREED

Fierce competition means every EPS penny could drive a big swing in share price. Management focus emphasizes staying on pace with competitors in order to maintain share price growth. Bank executive incentives encourage withholding embedded loss information when times are good. Building the embedded losses inventory is more likely in a high P/E environment. A high P/E provides an attention-focusing signal that investors are paying for growth.

Thus, in good times and within accounting rules boundaries, embedded losses are more likely to be withheld as private information.

IN BAD TIMES: The dominant market decision psychology = FEAR

Motivation works the other way in bad times. Management focus emphasizes risk management and protecting the franchise. Bank executive incentives include releasing embedded loss information when times are bad. This is like flushing the potty with all the other muck. Releasing embedded loss inventory is more likely in a low P/E environment. A low P/E provides an attention-focusing signal that investors are paying for risk control.

Thus, in bad times, embedded losses are more likely to be revealed as public information.

Please note: Just because a bank executive has a system's incentive to increase the embedded loss inventory by holding loss information private, does not mean they will do it. There are many high-character executives that do the right thing even when self-interested incentives suggest a different path. However, the system's incentives tend to be relentless. If the system's incentive points toward holding loss information private, across a portfolio of banks, an increase in the embedded loss inventory is more likely to occur. It is a statistical game impacted by groupthink and other decision-making process challenges.

Also, the degree to which the regulatory approach is principles-based v prescriptive matters. As mentioned earlier, the regulatory pendulum has swung toward a prescriptive approach. That means, what is not prescribed is more likely to be added to the private and potentially unknown embedded loss inventory.

John Kenneth Galbraith was a world-renowned economist, diplomat, and public official. He had another name for embedded losses. Dr. Gailbraith called it "The Bezzle." [iv]

“At any given time there exists an inventory of undiscovered embezzlement in—or more precisely not in—the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle."

Today, the embedded loss mindset has recently changed. The greed-to-fear mindset transition is in motion. In the banks' “new normal,” the regulators will relentlessly seek to uncover and resolve the banks' embedded loss inventory. Based on the KBW bank stock price index [v], banking stock prices dropped 30% in less than 3 months after the SVB failure.... meaning trailing P/Es have dropped as much. Lower P/Es provide executives with more release-the-bad-news agency. Dr. Gailbraith suggests a connection between the size of the embedded losses inventory ("The Bezzle") and the business cycle. As such, we are likely near the embedded loss "Build to Release" transition point in the business cycle. This is where the embedded loss inventory will likely peak.

Do not be surprised if bank executives seek to flush their embedded losses.

I’m reminded of James Madison University’s Finance professor Adam Usman’s 2022 draft paper – “Credit Rating and Stock Price Crash Risk.” Dr. Usman and I had a lively discussion on how embedded loss information release timing impacts stock prices.

Today - Dr. Usman’s thesis seems more relevant than ever.

Embedded losses are more likely to be revealed at this point in the business cycle. That is, formerly private loss information is more likely to be made public. Falling bank P/E ratios provide a signal that bank investors believe now is a good time to clean the house. Also, not all bank P/E ratio embedded loss signals are the same. New York University provides a January 2023 P/E study. The timing of this study is just prior to the SVB failure and the embedded loss transition. At this time, larger Money Center Banks (current P/E = 7.12) had a much lower P/E than their smaller Regional Bank cousins (current P/E = 25.81). This suggests the embedded loss clean-the-house signal is stronger for these smaller banks.

The impact of unrealized losses, decision process environments, along with banking and regulatory challenges and solutions, are explored in the article:

Notes

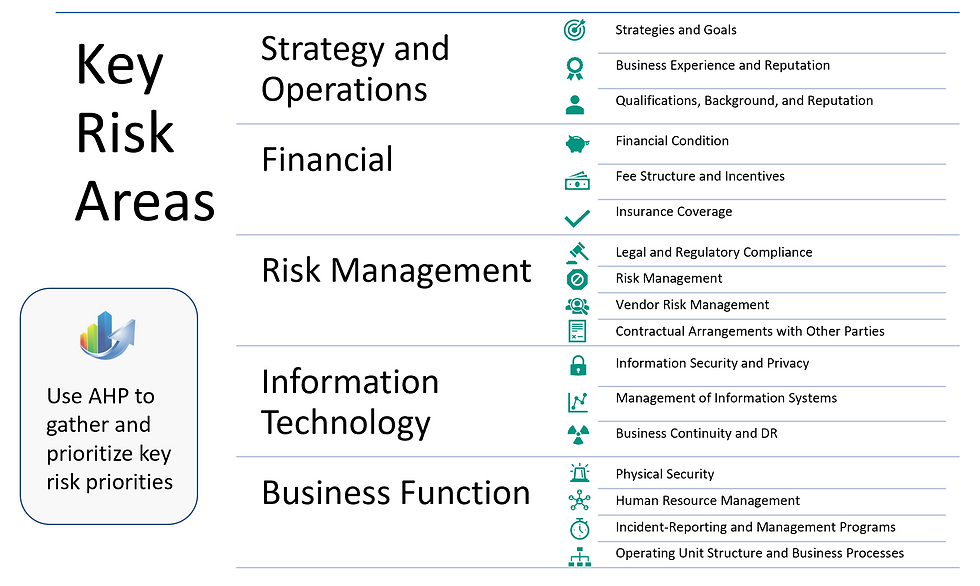

[i] We broadly define embedded losses, whether known or unknown, within the "Key Risk Areas" structure typically found in broader compliance risk assessment categories. Such as:

[ii] Accounting rules and standards, such as those promulgated by the Financial Accounting Standards Board ("FASB") and the Generally Accepted Accounting Principles ("GAAP"), are required to be independently audited for publically traded, stock-owned firms. Recently failed banks, such as Silicon Valley Bank, Signature Bank, and First Republic Bank were all publically-traded at the time of failure. Interestingly and coincidentally, all three failed banks were audited by the same "Big 4" auditing firm, KPMG, LLP. Full disclosure, the author of this article is a former KPMG Managing Director and still has his KPMG retirement benefits.

There have been some media accounts questioning the audits and calling for an investigation. Given my knowledge of KPMG, I would be shocked if much comes of an investigation. The firm certainly knows the accounting rules and is very good at documenting evidence and providing the paper trail supporting its accounting rule compliance assertions.

The bigger question is "What do we expect of our accounting audits?" Accounting rule auditing is actually relatively narrow from a risk management standpoint. A firm can certainly follow all the accounting rules, straight to bankruptcy or failure.

Foley, Three failed US banks had one thing in common: KPMG, The Financial Times, 2023

[iii] Why are unprescribed risks more likely to be missed? Why are not prescribed risks more likely to be added to the private and potentially unknown embedded loss inventory? This has to do with the amount of time and resources a bank has available to manage its risks. Bank risk management exists in a resource-constrained environment. In all my years in risk management, both in large and small banks, I've never seen a risk management budget sufficient to fully inspect and manage all bank risks. This means the bank must make trade-off priority decisions regarding which risks it is going to chase to optimally manage its loss portfolio. The bank has choices in terms of chasing known, or prescribed risks -- Vs. -- unknown or unprescribed risks. The challenge with the regulatory prescribed risks is that rule makers and supervisors are always playing catch-up. It takes time to evaluate and implement new laws for prescribed risks. Political posture also plays an important role in new rule writing. Over time, some executive branch or legislative branch bodies are more or less interested in updating legal prescriptions.

Some risks may persist over time, some may not. In our fast-moving and dynamic world, new and unprescribed risks are constantly emerging. Thus, the balance between principles-based and prescriptive regulation is a delicate balance. Some would argue the "not-again-on-my-watch" regulatory posture from the financial crisis oversteered toward a prescriptive regulatory balance. As such, regulators have gotten really good at regulating past risks. While banks are busy "checking the boxes" for their regulator, this does not leave enough time for banks to manage the future-leaning unprescribed embedded risk inventory.

In the case of the risks on-point for the recent bank failures -- the legal prescriptive rule writing was not focused on the impact of unrealized losses in a quickly increasing interest rate environment. Thus, all involved had plausible deniability that they followed the rules. The rules were followed all the way to the FDIC's failed bank list and the taxpayers' pocket.

Some may call to add more rules or "prescriptions" to better handle unrealized losses. This is like the dog chasing its tail. Alternatively, it may make sense to go in the other direction. That is -- provide the regulators and senior bank leaders with clear principles, expectations, and accountabilities that whatever the risk is, they are responsible for properly supervising or managing the risk portfolio. The principles will empower supervisors and senior bank leaders to focus on the key risks to their bank. This may include unrealized losses, but it may include other risks lawmakers or rule writers have not yet anticipated. The objective is to reduce embedded losses, especially those generated during the good times of the business cycle.

Prescriptive v. principles-based regulation is discussed in the context of systemic risk:

Hulett, The Systemic Risk Paradox, The Curiosity Vine, 2023

[iv] “At any given time there exists an inventory of undiscovered embezzlement in—or more precisely not in—the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle. In good times people are relaxed, trusting, and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly. In depression, all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.”

- John Kenneth Galbraith

Galbraith, The Great Crash 1929, 1954

[v] KBW Bank index from March 1st to May 2, 2023

Kommentare