Why your career personality risk profile drives long-term wealth

- Jeff Hulett

- Apr 7, 2023

- 10 min read

What are the best career risks to take? How do you adapt your personality to drive personal wealth? Jeff Hulett approaches career decisions as a personal finance decision.

The bottom line is - do not let anyone tell you you are not good at something. You can achieve that which you put your mind to.

This is an excerpt from our article: They kept asking about what I wanted to do with my life, but what if I don't know? - Part 1

Career segments and making job changes

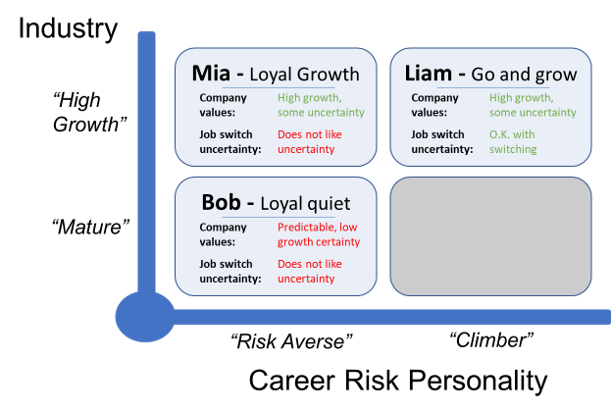

To help further build on attitudes and behaviors discussed in our "They kept asking" article, the above graphic shows 3 segments based on 2 important career dimensions. In part 2, we provide a more fulsome description of the segments, as represented by our fearless personas - Liam, Mia, and Bob. Before we dig into the segments, we will describe their defining career dimensions.

Career Risk Personality - Risk-averse or climber?

First, let’s start by defining the Career Risk Personality. We all have a career risk personality that drives our career progression. Our adaptability and how we handle uncertainty is often the key driver of our career choices. A person able to appropriately evaluate and move forward in the face of uncertainty shows “climber” tendencies. One that is less able to move forward in the face of uncertainty shows “risk-averse” tendencies. Our willingness to change companies is often a significant driver of our compensation as salary jumps are generally higher when changing companies. Career Risk Personality is a big deal, as our models will demonstrate later in the article. To be clear, I consider Career Risk Personality a learned behavior, not some genetic destiny. Our starting point will likely be the result of how we are taught in childhood. As an example, Reshma Saujani, founder of Girls Who Code says:

"We're raising our girls to be perfect, and we're raising our boys to be brave"

Ms. Saujani suggests women may be more likely to fear uncertainty because of how our daughters are raised. Naturally, this is a generalization based on Ms. Saujani’s experience, your experience may be different. The point is - if desired and with some work - we can all adapt our Career Personalities.

The French philosopher Voltaire said:

“Perfect is the enemy of the good.”

In this case, “Perfect is the enemy of making more money!”

For more information, including an empirical study demonstrating the impact of matriarchal and patriarchal cultures, please see our article: How braver people, especially our daughters, achieve more career success.

Understanding how employers manage Career Risk Personality and related policies is important to your long-term value creation opportunity. For new employees, companies offer salary increases as a job change incentive. For current employees, companies often mute their ability to adapt to the current market salary. This “current employee - mute” or “new employee - increase” is accomplished by HR or Finance corporate policy. Many companies have broad job category salary ranges to accommodate new employee salary increase incentive needs, but that does not require them to increase current employee salaries to current market levels. As an example, here is a quote from May 24, 2021, in The Economist article called “Why paying a pittance is passé.” Notice, average current workers will not be caught up until 2024, whereas new employees get an immediate increase:

“…entry-level wages for new hires would go from $11 to $17 an hour and that average wages for all staff would reach $15 by 2024”

Lagging current employee salaries is a standard Finance / HR department business management approach to both increasing wages to attract new hires and lagging the increase for existing employees to protect profitability. Lagging or even reducing salaries is more likely in firms with professional business managers from MBA schools. MIT economist Daron Acemoglu shows in a recent paper that companies with professional business managers are more likely to decrease salaries. Even though, over the period of study, total firm value creation does not increase. [vi]

Some of the underlying factors driving lower wage growth within the same company are:

Information Asymmetry - the employer has more information than the individual employee or job seeker, and

Market Subjectivity - your market salary can be subjective and not always easy to determine.

Employee Inertia - companies rely on a “fear of change”-based inertia to reduce the need to adjust current employee salaries.

As such, changing companies to improve your salary by adapting to market inefficiencies is an employment market strategy arbitrage. Those that are willing to arbitrage their skills and abilities [vii] have a great opportunity to create wealth. We will show the value of this arbitrage later in the article.

Industry - High Growth or Mature?

We also have the choice of different industries for our careers. This is significant as our employment value becomes more industry-specific as we become more senior. Our ability to switch industries and increase salary may decline as our value becomes more industry-specific. Making a good industry choice regarding growth opportunities will make a difference in your long-term salary and wealth-building ability. As we will show in our models later in this article, ”high growth” industries drive more long-term personal wealth than “mature” industries. The U.S. Bureau of Labor Statistics (BLS) has a treasure trove of information regarding industry growth.

By the way, in 2022, the pandemic is forcing many to rethink their industry choice. The U.S. has and will face labor shortages as market demand moves faster than people can change industries. This friction may create salary inflation. As said in a recent The Economist article [viii]:

“It takes time for people to move from dying industries to growing ones.”

For those thinking of an industry or company change, the pandemic may represent a once-in-a-generation opportunity. In fact, the U.S. job turnover rate has been accelerating, with the average turnover rate now being below 2 years. This means that if you are not changing jobs every 2 years, you are not changing jobs as quickly as the U.S. average. [ix] The point is, job change consideration should be a standard part of a healthy life evaluation. Also, another way to think about a growing industry is in terms of its compensation upside compared to its downside. See our article Why convexity is a helpful career guidepost for an approach to considering upside and downside when evaluating an industry or company.

Next comes the arbitrage opportunity. To describe the arbitrage, we answer the question:

"What are the potential personal finance implications regarding the different career segment choices?"

I call this an arbitrage, because you have the opportunity, especially when you are younger, to make high-value career decisions. In effect, you are buying your skills out of a lower-value career market segment and selling your skills into a higher-value career market segment. This is the essence of a classic arbitrage trade. As such, the following analysis helps you understand the long-term value opportunities based on three different persona segments.

Next, we meet Liam, Mia, and Bob….

Notes

[i] Hulett, Do I need to be a data scientist in an AI-enabled world? The Curiosity Vine, 2019

[ii] Dweck, Mindset: The New Psychology of Success, 2006

[iii] The brain is incredibly complex. There is significant interaction between all the components of the brain, including neurotransmitters - like dopamine. For a related practical example, see our article on how our brains engage the political process.

Hulett, Your vote does not matter as much as it should!, The Curiosity Vine, 2021

[iv] Levitt, Interview with University of Chicago Behavioral Scientist Sendhil Mullainathan, People I Mostly Admire Podcast, 2021

[v] Hulett, Changing jobs? Why accuracy is more important than precision, The Curiosity Vine, 2022

[vi] Background: Dr. Acemoglu and the co-authors' paper is most interesting. The paper suggests a correlation and causation between companies hiring MBA school professional managers and decreasing salaries. They suggest their approach establishes a higher standard of causality. This means the authors assert that it is the MBA school training that caused wages to go down. I have a related but different theory. My behavioral economics training, including experience with availability bias, suggests a more subtle causal reason to investigate.

There is an old management saying: "Inspect what you expect." The idea is, via active inspection, that business leadership is sending a clear message about what they expect through regular monitoring. In my experience, this is a useful tool to drive performance for that which is inspected. The background for this comes from behavioral economics. Availability Bias is a powerful decision-making bias. It has to do with salience. Research consistently shows that the most salient decision inputs are going to be more available to the decision-maker. Thus, more available decision inputs are likely to be overweighted in the decision-making process.

Thus, the theory to explain the impact of MBAs on wages is this:

Situation: Via their education, MBAs are given a bunch of tools, which include managing expense lines. This training enables reducing factor input costs, including labor costs. But in recent decades, MBAs are also taught "Stakeholder Capitalism" which combines the needs of the shareholder, along with the customer, the employee, and the community. So, I think it is a stretch to blame MBA schools. This would be like blaming a toolbox for the misuse of a hammer.

Then, what else could be a root cause of MBAs association with lower wages? To start to unpack this question - the U.S. S.E.C. requires quarterly reporting and even private companies often follow a quarterly reporting cycle. The reporting is short-term and focused on the Income Statement (Revenue and Expenses) and Cash Flows.

Complication: The MBA graduate certainly has extensive training in U.S. S.E.C. required reporting for public companies. The quarterly reporting makes expense lines and cash impact, like labor costs, VERY SALIENT to the professional business manager. However, longer-term outcomes impacting the customer, the employer, and the community are much harder to see, thus much LESS SALIENT for the professional business manager. Therefore, the professional business manager MBA will focus on what he can control and what is most salient to demonstrate their value (like squeezing labor costs and improving cash availability). It is much more challenging and less salient for the professional business manager MBA to focus on the other longer term and harder to see stakeholders' value metrics. Also, professional managers often have incentives to drive short-term profitability. Think of incentives as "salience enhancers" that increases availability bias.

Thus, my theory involves our naturally occurring availability bias. It is the availability of wage expense information via U.S. S.E.C. required and related quarterly reporting that are a root cause of MBAs overweighting these decision inputs. The outcome of overweighting salient decision inputs drives short-term profitability and cash availability, but likely does not drive other stakeholder priorities related to long-term value creation. Incentives may drive enhanced availability.

Blaming the MBA university program is like blaming the toolbox if a carpenter uses a faulty hammer.

Resolution: As such, I suggest that professional business managers should find a way to update their reporting and compensation incentives enabling equal salience across all stakeholders. Also, as a line of inquiry, Dr. Acemoglu and his team may want to investigate this as a root cause.

Acemoglu, He, le Maire, Eclipse of Rent-Sharing: The Effects of Managers' Business Education on Wages and the Labor Share in the US and Denmark, NBER Working Paper No. 29874, March 2022

[vii] Skills and abilities have specific meanings. Generally, we think of skills more like tools we can put in our tool bag. They are generally based on rote learning from school or practice at work. It may include analytical skills, software knowledge, writing proficiency, knowledge about history, science, etc. Skills are generally inward-focused. Abilities are generally more linked to our personality. They will include leadership abilities, collaboration abilities, team-building abilities, etc. Abilities are generally outward-focused.

Skills can generally be taught quickly, abilities take longer to develop, and may even not be possible to develop without a willingness to change personality. Ray Dalio does a commendable job describing this dynamic in his book Principles.

[viii] The Economist, May 15, 2021, “The Bottleneck Economy.”

[ix] The turnover rate is calculated from the Bureau of Labor Statistics (BLS) data: monthly nonfarm employee balance / (monthly new hires *12). This represents a job turnover rate of 30% over the last decade. The pandemic appears to be a continuation of an existing trend.

Further Reading:

Foundation

High School Students

College Students

10. College Success!

Career and Beyond

The Stoic's Arbitrage: Your Personal Finance Journey Guide

Core Concepts

Making the money!

5. Career choices - They kept asking about what I wanted to do with my life, but what if I don't know? - Part 1

6. Career choices - They kept asking about what I wanted to do with my life, but what if I don't know? - Part 2

7. Career success - Success Pillars - A Life Journey Foundation

8. Career choices - Do I need to be a Data Scientist in an AI-enabled world?

9. Career choices - Diamonds In The Rough - A perspective on making high impact college hires

Spending the money!

10. Budgeting - Budgeting like a stoic

11. Home Buying - Homeownership is an important wealth-building platform

12. Car Buying - Cutting through complexity: A car buying approach

13. College choice - The College Decision - Framework and tools for investing in your future

14. College choice - College Success!

15. College choice - How to make money in Student Lending

16. Event spending - Wedding and event planning guiding principle

Investing the money!

Pulling it together!

Comments